By Chris Klauda

STR

With employees continuing to return to offices, ongoing vaccination progress and the reopening of many international borders, the time would seem to be ripe for the return of business travel.

Yet, even before the news of the omicron variant in recent days, there continued to be negative sentiments about the return of this segment, whereas pandemic-era leisure travel sentiments remain buoyant.

Results from a November STR survey of 600 global travelers indicates that more consumers are less likely to travel for overnight business amid the pandemic: 44% in November 2021 versus 39% in July 2021. Additionally, net propensity to travel, which is the difference between those more likely and less likely to travel, was down 30% in November 2021 after coming in down 27% in July 2021.

Analysis of business travel sentiments across different age groups reveals only a slightly less negative sentiment among younger business travelers compared with those in older age groups. The narrowing sentiment highlights that the views of younger and older audiences are converging. This may be due to increased confidence in traveling among older audiences because of vaccine success as well as decreased confidence among younger travelers, who are typically less risk-averse — possibly due to fears of long-haul COVID-19, which is reported to be more prevalent in younger people.

Ultimately it is the business, not the employee, that will decide when business travel returns. Businesses have enjoyed significant cost savings over the past 20 months with reduced travel expenses, while still generally being able to deliver products and services, which has greatly benefited their bottom lines. Additionally, corporate policies and concerns of corporate legal departments about duty of care if an employee contracts COVID-19 while traveling have curtailed some business travel.

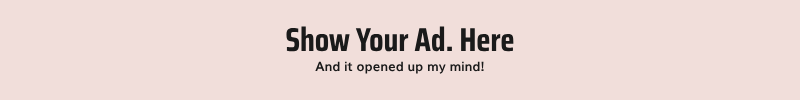

Compounding this negative sentiment toward business travel are attitudes regarding business travel more generally. When asked whether travel for business purposes will return to pre-pandemic levels, more than half disagreed. On the positive side, there is a small segment that is optimistic, with more than one-quarter of business travelers agreeing that travel for business purposes will return to levels experience before the pandemic.

New Opportunities: ‘Work-cations’ and ‘Collaboration Travel’

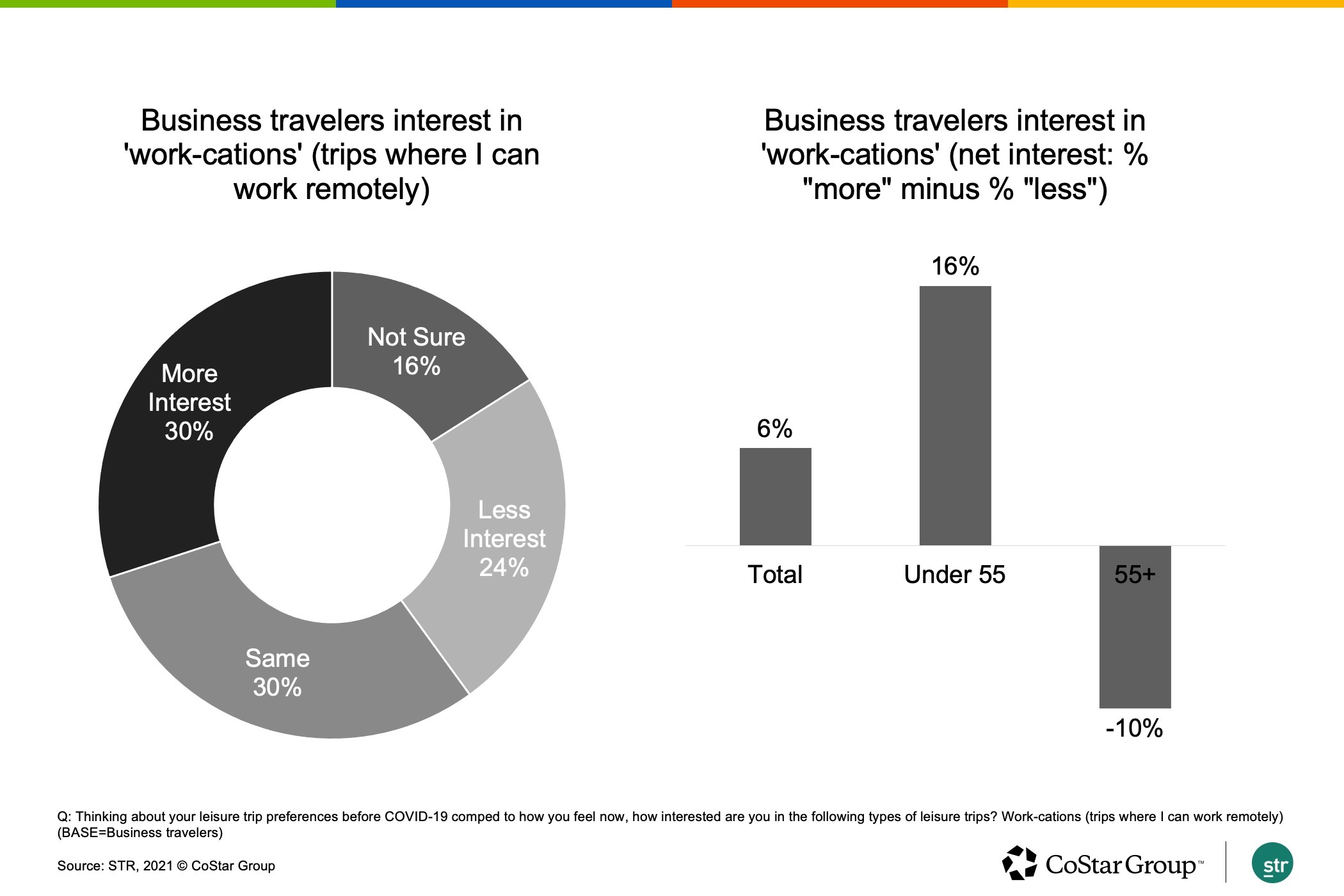

A phenomenon that gained momentum during the pandemic and one that may offer some positive news for the travel industry is the “work-cation.” There was positive sentiment about the concept of being able to work while traveling among business travelers surveyed. Almost one-third (30%) of business travelers stated they would be more interested in a “work-cation” compared with pre-pandemic times, resulting in a net positive interest score of 6%. Among younger business travelers, interest was more than twice as high with a net positive of 16%.

While the “work-cation” will not come close to replacing traditional business travel, it is one of many new opportunities that could be pursued as the world adjusts to new ways of doing business.

Another opportunity for increased business travel may come from the need to bring together remote-working teams for regular on-site, in-person meetings to strategize, collaborate and set goals. With more and more employees working remote, the need for “collaboration travel” will continue to increase, helping to fill hotels with a new version of business travel.

Where business travel ends up remains to be seen. With so much of the employed population having been confined for months working from home and countless online meetings, the hope is that traveling to meet and interact with colleagues and clients again will resume in new forms and with renewed vigor. We will continue to explore hypotheses and trends in further COVID-19 traveler trends research and blog posts.

NOTE: This research was undertaken in early November 2021 before the omicron variant emerged. As a result, respondents’ views do not represent the newest situation around COVID-19.

Chris Klauda is senior director of Market Insights at STR.

This article represents an interpretation of data collected by STR, parent company of HNN. Please feel free to contact an editor with any questions or concerns. For more analysis of STR data, visit the data insights blog on STR.com.